Fraud in classified ads

While classified ad sites can be used to do things like buy or sell items, some fraudsters use them to lure people in and take their money.

To help you avoid becoming a victim of this type of fraud, here are two examples of classified ad scams.

Bitcoin and cryptocurrency investments

$5,000 negotiable

We are a registered1 global2 investment firm involved in mining and cryptocurrency and foreign exchange trading. We also provide portfolio management and investment services, using complex trading3 and risk management strategies such as short sellingShort selling occurs when you sell a security you do not own.

An investor borrows a security from a dealer or other financial intermediary and sells it immediately on the market. The investor will later have to buy back the security and deliver it to the intermediary.

If the security declines in value, the investor can buy it back (redeem) at a lower price. His profit will be the difference between the selling price and the redemption price.

This investment strategy can be extremely risky. If the value of the security rises, the investor will have to pay back the difference and will therefore suffer a loss. Theoretically, the loss could be unlimited. For sophisticated investors only! , leveraging and derivativesA derivative is a financial product whose price fluctuates based on the price of an underlying interest, such as shares, an index or another financial product. to enhance our performance. We manage peoples’ investment funds and generate returns for them.

We offer a number of plans, including:

- Best deal: generates a 10%4 profit per month

- Basic: generates a 13% profit per month

- Premium: generates a 16% profit per month

- Deluxe: generates a 19% profit per month

We also offer an instant 0.5% bonus for each investor referred to us.5

We’re looking for companies and individuals and we would be delighted to have you join us. You can reach us from any country in the world.

To find out more about this unique business opportunity, contact me by e-mail.

Yours truly,

Mr. XYZ

[email protected]

There are several fraud red flags in the ad:

- Despite the ad stating that the firm is “registered,” you can’t check whether the purported global investment firm is registered with the AMF because its name isn’t mentioned. An authorized firm would most certainly state its name.

- Mr. XYZ is not authorized to offer you investments because he isn’t listed in the AMF registers.

- Fraudsters try to highlight their (fake) expertise by using complex words.

- The returns offered are completely unrealistic. Some fraudsters might offer more realistic rates to avoid raising suspicions, but they will still make sure the opportunity is appealing in order to attract investors.

- The fraudster wants your help recruiting victims. Be careful! Recommending an investment, even to your friends, could constitute solicitation. There are laws and regulations governing solicitation. If you don’t comply with them, you could end up committing an offence, too.

Fraudsters may take advantage of your situation and propose that you withdraw money from your RRSPAn RRSP, or Registered Retirement Savings Plan, is a registered account (an account with a bank or on-line broker, for example) in which investments can be made, the returns on which are not taxable as long as the money stays in the RRSP.

Investors who make contributions to their RRSP can deduct an equivalent amount from their taxable income (subject to certain conditions) and, as a rule, pay less tax.

However, when amounts are withdrawn from an RRSP, they must be added to taxable income.

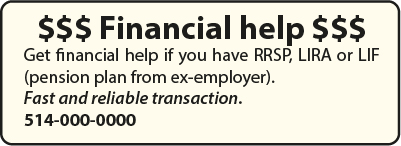

The main purpose of an RRSP is to accumulate savings for retirement. (or LIRAA Locked-In Retirement Account (LIRA) is generally used for investing money coming from a Supplemental Pension Plan (SPP). The income generated by the investments in a LIRA is not taxable as long as it remains in the LIRA. To move money out of a LIRA, it must either be transferred to a Life Income Fund (LIF) or used to buy a life annuity from an insurance company. or pension fundA pension fund is a fund that pays retirement benefits. It includes contributions and income generated by these contributions.) tax-free. Beware: Classified ads are used for this to attempt to defraud you using a strategy called “RRSP fraud.”

How do fraudsters operate?

Here’s an example. The fraudster offers you his “expertise” to conduct transactions on your behalf. He asks you to:

- Transfer your RRSP or LIRA to an investment dealer (a discount brokerA discount broker is a broker who makes it possible to buy and sell securities (shares, etc.) at a lower price. In general, the broker does not offer clients any personalized advice.

A discount broker often has a website that allows clients to carry out transactions on their own, without any human contact. or an on-line dealer). This type of dealer gives you an account that you can access using a password. - Give him your password so he can access your account in order to manage your investments.

Here’s one tactic that fraudsters might then use to enrich themselves at your expense:

- Using their own money, the fraudsters buy a large number of shares in a small company. Due to scarce demand, the company’s shares aren’t very liquid. They’re worth almost nothing.

- They then buy shares in the company with your money but at a distorted price. They are able to do this because the shares are not very liquid. The price goes up temporarily.

- When this happens, the fraudsters sell the shares owned by them. They make a huge profit.

- Since no one else wants to buy the company’s shares, the price goes back down. Your investment is now practically worthless. You’ve lost your investment.

To prevent this type of fraud:

- Avoid making investments based on classified ads. It’s risky!

- Make sure the representative and firm you’ll potentially be dealing with are authorized by the AMF to sell the product they are offering.

- Confirm the identity of the person you’re speaking with by calling the number listed in our register (not the number the person gives you).

- Don’t be fooled by people who claim they can deliver incredible returns, whatever the explanation they give for being able to do it, including:

- an ability to predict stock market movements

- the use of artificial intelligence

- the application of complex strategies reserved for major institutions

- You should know that any amounts you withdraw from your RRSP, LIRA or pension fund are taxable. Be wary of anyone who tells you otherwise.

- Don’t accept offers that sound too good to be true: They usually are.

- Insist on being given documents that explain the investment. Make sure you read them and clearly understand the information they contain.